- cross-posted to:

- housing_bubble_2@lemmy.world

- cross-posted to:

- housing_bubble_2@lemmy.world

Huge corporations stockpiling houses to gouge Canadians and make them rental slaves for life:

Vancouver/BC tried the empty house tax. T’fuck… Literally drops in the bucket…

We can’t tax the rich, that is anti oligarch/anti monopoly policy. Won’t anyone think of the shareholders? They have 4th homes to buy and a 2nd cottages in their sights, now with parking for 2 yachts.

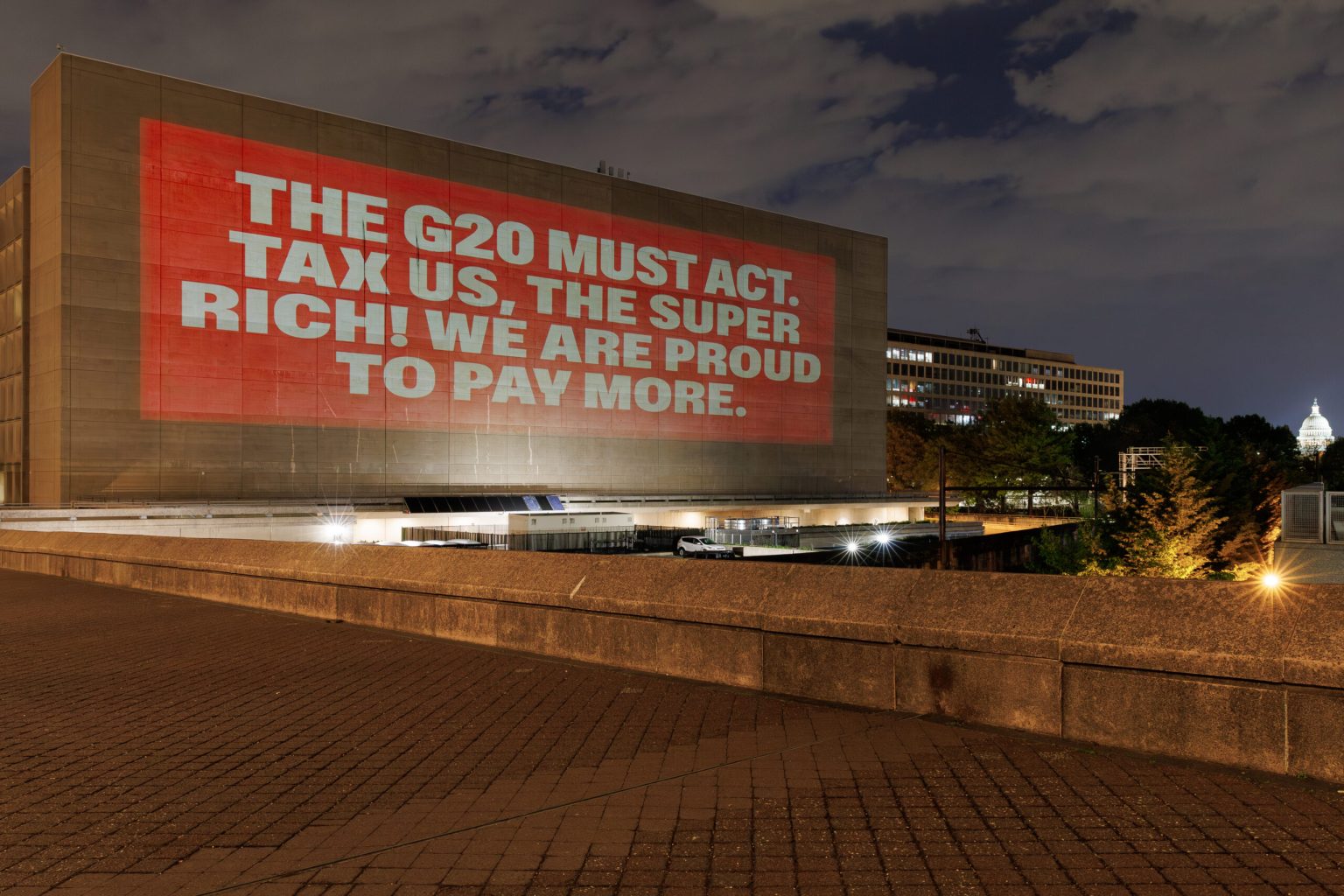

Taxing the rich would help fix much more than that.

US here. Samesies!

Great article. “Financialization” is a word that should be more popular. When news media and rental properties become investment vehicles, the public suffers.

In 2023, rents increased by eight per cent while wages grew by only five per cent. At the same time, the real estate sector collected $50.4 billion in profits in 2023 — a staggering 40 per cent higher than its pre-pandemic record.

Much of these wildly outsized real estate profits are being generated through corporations and financial firms. These firms own 20 to 30 per cent of purpose-built rental housing and are the majority purchasers of multi-family dwellings in Canada. In particular, real estate investment trusts (REITs) have grown to two-thirds of all real estate assets traded on the TSX.

Similar to hedge funds, REITs are trusts that must hold the majority of their assets in real estate and distribute most of their profits to investors each year. Over the past few decades, REITs have become a significant presence in the rental market. They’ve gone from owning zero rentals in Canada in 1996 to nearly 200,000 units today.

One key reason that REITs are so popular: their income is distributed to investors tax-free. In 2022, $100 million collected by the largest seven residential REITs was distributed to investors, exempt from taxation through the partial inclusion of capital gains. While the capital gains loophole was lowered in 2024, it still results in a sizeable tax break.

REIT profits must be taxed

Despite experts pushing relentlessly for the federal government to take action, the finance department quietly posted that “no changes to the tax treatment of REITs are being considered at this time” on their website in May 2024, leaving renters at the mercy of financial firms.

“taxing” when there is a crisis is asinine. Take from those who have too much and GIVE to those who are in desperate need. Fuck this shit.

If you taxes the rich they will leave and stop investing. That’s how countries become poor. You plebeians needs the riches because they are smarter than you and creates wealth.

If these “richies” were actually investing their money in making the country better, we wouldn’t be having this conversation.